FORWARDED TREASURY BOND OFFER

petroleum product :: Your first category :: petroleumproduct & crude oil & Mazut M 100 & steam coal & crude oil

Page 1 of 1

FORWARDED TREASURY BOND OFFER

FORWARDED TREASURY BOND OFFER

Subject: FORWARDED TREASURY BOND OFFER

To:

Please see the T-Bond offer below that I received. Two of the Bonds in the attached chart, I have been advised, are already matured.

Also, please take particular note of my Securities Disclaimer below. Thanks.

"Hello,

Please see below. This is an excellent opportunity to acquire deeply discounted UST's from a Tier 1 platform. The offering price is discounted 15% from Par and not the trading price. As you know the longer-term treasuries often trade in the 130's and 140's due to the coupon. This is a great chance to get a 40 to 60 point spread.

Also, there are 2.50 points available to the buy side and you can take 1.25%.

The ISINS below are a sampling of the Inventory the seller had back in March/April.

The ISINS that your buyer is going to receive will be newly issued and all will be trading.

The discount is based on the Par value and not trading values.

A T-3 is possible.

Mark,

The below is from my contact who is paid on the sell side.

Hi Mark,

We are directly connected to a Mutual Funds Trading Platform which gets quarterly allocations from the US Treasury Department. This Mutual Fund which was established some 84 years ago works through a SPV to service the Buyers in the secondary Market who would like to purchase Treasury Bonds + STRIPS.

At present we are working with this company with our direct Buyer who has passed due diligence with the SPV + MUTUAL FUNDS and are now awaiting the green light from the Treasury Department to commence the Trade, desk to desk. The package that our buyer has been approved for is $100B+.

These Treasury Bonds come with a deep discount. The discount is 25 Gross off of par! The Buyer gets a Net discount of 15% off the face value of the amount he is purchasing. There's 5% that goes to the SPV and 5% fees split between the Seller's Consultants (2.50%) and the Buyer's Consultants 2.50%. The Buyer's 2.50% is FULLY Open and it starts with you. The Buyer's Rep MUST include you and other consultants who are working with you in the 2.50% as there is more than enough for you to get fair compensation.

It is important that your Buyer request the maximum volume that their buying capacity would allow. There are no Rolls & Extensions! Should the Buyer select $50B he would receive multiple ISINS that amounts to that request. He needs to be able to trade the full amount based on a minimum of 10% per tranche of the face value approved and arranged desk to desk.

In order for us to proceed we are providing here below the Procedures which are non-negotiable. Should your Buyer be unable to follow these procedures, just walk away from this. I am talking from experience dealing with this source. They will NOT NEGOTIATE as they don't have to!

PROCEDURES

Buyer submits a simple LOI on his Letterhead with his CIS stating the amount of UST Bonds he/she would like to purchase and indicating what he/she intends to do with the Bonds once purchased. Are they buying to Hold, Trade or Flip!. This LOI must come from the REAL Buyer, not a company who plans to sell to another Buyer. This is very important as you will note from the below continued procedures. Seller conducts a Preliminary Due Diligence on the Buyer and within 48 hours would then pull two (2) or more ISINS depending on the amount the Buyer would like to purchase. These ISINS would then be sent in a Preliminary offer together with a Pay Order to the Buyer.

The Buyer would then have 48 hours to review and accept the offer as he/she would have those ISINS exclusively blocked for the Buyer.

The Buyer would then sign the Preliminary offer and the Pay Order and provide his/her desk details and send it directly back to the Seller's email address. It's important that the account information provided by the buyer is the same as Buyer's name and or company as provided in the LOI.

The Seller then within 24 business hours would sign & seal the Preliminary offer in wet blue ink which would then become THE FINAL OFFER and return this directly to the Buyer.

The Seller will submit the package to the Treasury department which ONLY accepts files on Wednesdays. The process for final approval to trade could take 3 weeks so patience is of the essence as you cannot rush this process.

As soon as the Treasury gives their final approval, the Seller's desk will contact the Buyer's desk to finalize the details to commence the trade. If the Buyer has previously purchased US Treasuries or is an actual Institutional bank or financial Firm DESK ...then the following applies:

The returning Buyer submits corporate name and address and Corp Id Number and desk information. * As a desk Buyer... the bank affiliation and CRD# of the desk officer or trader is all that is required. Desk Buyers take priority in the QUE...

Both of these types of Buyers bypass Treasury compliance and can be verified in the databases to which the Seller's SPV has access.

PLEASE NOTE: DURING THE COMPLIANCE there will be ONLY 1 PRINCIPAL call as part of the VERIFICATION PROCESS. THIS IS THE ONLY CALL.

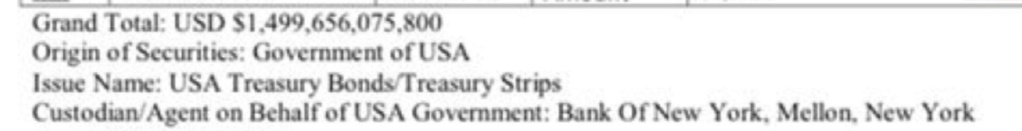

Here's our last batch total ..... there is about 400B remaining of this batch and we have 2 more available.

Please note that these are only a representative sample."

Let me know of your Buyer's interest. Thanks.

Best regards and stay safe and healthy!

Similar topics

Similar topics» Subject: FORWARDED TREASURY BOND OFFER

» U.S. Treasury Notes and Bonds.

» United States Treasury Bonds

» Offer OIL SOFT CORPORATE OFFER КОММЕРЧЕСКОЕ ПРЕДЛОЖЕНИЕ

» Offer Rough Diamonds offer at Brinks Dubai

» U.S. Treasury Notes and Bonds.

» United States Treasury Bonds

» Offer OIL SOFT CORPORATE OFFER КОММЕРЧЕСКОЕ ПРЕДЛОЖЕНИЕ

» Offer Rough Diamonds offer at Brinks Dubai

petroleum product :: Your first category :: petroleumproduct & crude oil & Mazut M 100 & steam coal & crude oil

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum